Feautured Image Source: Singapore Savings Bond

Singapore Savings Bond (SSB) launched its latest tranche of SSB today and to me this is the juiciest short term rate I have ever seen at 2.01%.

At 2.01%, this is already higher than most or even all fixed deposits available in the market. Therefore, I am writing this post on why I feel SSB is really the best investment product ever created in Singapore and how SSB can be compared with Fixed Deposits and single premium endowment plans.

Why SSB?

SSB is backed by the Singapore Government which has a credit rating of AAA by few international credit rating agencies such as Moody’s and S&P. Having a credit rating of AAA means that the likelihood of the Singapore Government to default on SSB is close to never. Not saying that it will not but there is still a chance. If it really happens then Singapore will be doomed.

SSB is meant for long term, low risk investment. For SSB, you can hold it for maximum of 10 years. If you hold longer, you will get higher average return thus having more coupon payment amount. You can redeem anytime and will not be penalised for doing so. I myself bought SSB in April this year but I redeemed few months later. I got back my principal amount and the accrued interest for the time I hold SSB. You will not lose anything if you withdraw prematurely.

You can start small with SSB. The minimum amount you can invest in SSB is $500 and in the multiples of $500. Everyone, no matter how large the purchase each time, will pay a fee of $2 to buy SSB. You will pay another $2 if you sell before the bond matures. Therefore, the most you will lose in SSB is $2 or $4.

How can SSB play a part in our lives?

SSB can be used for different purposes. Instead of putting our hard-earned money in deposit accounts that earn just 0.05%/pa, we can put them in SSB which now yield 2.01% per annum at the very minimum. Remember not to put all your hard-earned money in SSB. Only afford to invest in SSB if you do not need the money in the next few years. This is how the 6 months emergency fund is important over here. The con of SSB even though you can redeem any time you want is that the only time you get back your money is about one month after you request to withdraw. The pro tip is first, redeem the bond at the end of the month (specifically by 4th last business day of the month). This is because the proceeds will only be paid out by the end of the 2nd business day of the following month. This means that you do not have to wait very long to get back your money. If you are in need of money urgently, then do not put all your hard-earned money in SSB.

SSB can be bought for investment purposes. Bonds are popular among bondholders because they are paid before the shareholders since they are the creditors to the company which sells bond. Due to this reason, you will be assured that as long as the company is financially healthy, the company is less likely to default payment on you. Bonds can be used to cushion the losses you had in the stock markets. Remember how stocks and bonds are indirectly correlated. During recession, many people are selling shares to buy bonds because bonds are seen as a safe haven (Flight to liquidity). How SSB can help in your investment is that you will still receive coupon payment every 6 months from the government even during recessionary period.

How to estimate the next SSB tranche rates?

SSB coupon rates are based on the average of SGS reference yields. You can visit this website to estimate the rates by yourself to decide whether to wait for the next tranche or to buy into this tranche. I have estimated the rates before which I posted on InvestingNote one day before the official rates were released.

SSB website has also provided how SSB rates are determined. For those who are interested, you can check out the website here. In the earlier part, I mentioned how SSB encourages investor to hold longer to earn more interest. However, lately the yield curve is flattening. If the yield does not allow SSB rates to have step-up coupons, MAS will lower the coupon rates by the minimum amount necessary using a very complex mathematical formula to maintain a weakly monotonically increasing step-up coupon schedule. The adjustment is similar to reducing the size of the coupons in earlier years, and increasing the size of the coupons in later years, while adjusting for the time value of money based on the risk-free discount rates. These adjustments may cause the average annual compounded return on the particular Savings Bond issue over 1, 2 or 5 years to be less than the 1, 2 and 5-year reference yields. However, the adjustments will not affect the issue’s return if held to maturity, which shall always equal the 10-year reference yield (subject to slight differences of up to +/- 0.03% due to rounding in the computation of the step-up coupons).

If the SGS reference yield do invert then the above mentioned method will not work. As of now, one can still rely on SGS reference yield to predict the rates.

Why SSB and not fixed deposits

Source: Business Times

A week ago, Business Times published this figure containing some popular fixed deposits, alternative instruments and single-premium savings. The fixed deposits by our banks look very attractive with CIMB online offering 1.9% per annum. It is not that great deal if you look closer.

If you look at the fine print of the 1.9% CIMB Fixed deposit, it states that for you to get 1.9% interest rate, you have to apply online and to deposit $10,000 with them.

Look at the requirements for Maybank’s 1.88% fixed deposit. You only can get 1.88% interest rate only if you deposit $20k with them and to open an savings and current account and park with them $2k.

Why are banks introducing so many requirements like those shown above? This is because SSB became very popular among us and many of us are parking our funds in SSB instead of current and savings accounts. As a result, DBS CEO in the latest result presentation shared that Singapore CASA market has been contracting.

My point of showing two examples of fixed deposit promotions by the banks is that you require more funds to park money with the banks. In SSB, you get higher rates as long as you have minimum $500 to spare.

Secondly, unlike SSB where you will not be penalised when you redeem early, fixed deposits might imposed terms and conditions stating that one will not be able to receive any accrued interest earned or to receive no interest but just principal.

Comparing SSB with Temasek Bond and Single-Premium Savings

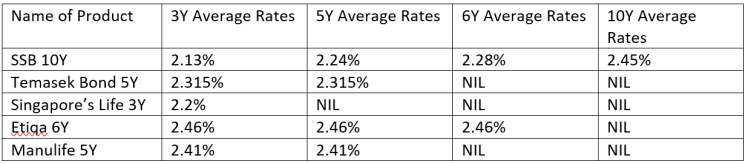

Temasek Bond is another bond that has the same credit rating as SSB. Temasek Bond is backed by Temasek which is indirectly related to Singapore Government. The Single-Premium Savings that we will be comparing will be based on the figures given by Business Times which are Singapore’s Life 3 Year, Manulife’s 5 year and Etiqa’s 6 year.

Looking at this table, you will be able to see that comparing SSB with Temasek Bond and Single-Premium Savings, SSB lose out in terms of the rates. Temasek Bond is currently priced above par value therefore the rate is not at 2.7% anymore but at 2.315% which is the bid yield to maturity. Currently, Etiqa 6Y offers the best rates. According to its website, the minimum amount to park funds with them is $15,000 and if one is to pay a lump sum amount, there will be upfront premium discount. This means you will receive a higher return after considering the premium discount.

Since SSB can be withdrawn without penalty and with accured interest, it should not seen as just for long term investment. Even for short term like needing the cash a year later, one can invest in SSB too.

LikeLike

Yeap! For me I am looking at SSB for short term rates only. However, I won’t put all my liquid cash into SSB because I only get my proceed one month after I redeem.

LikeLike

Someone mentioned this article on Twitter, and I’m glad I decided to give it a look!

LikeLike

Thank you for your support!

LikeLike

I very happy to find this web site on bing, just what I was looking for : D also bookmarked.

LikeLike

Wow, this was great. Keep writing this kind of posts, you will get a lot of people to this post if you continue writing this.

LikeLike

We really love your web site, it has engaging articles, Thanks!

LikeLike

Wow, this was awesome. Keep writing this kind of posts, you will get a lot of people to this post if you continue writing this.

LikeLike

Wow, this was awesome. Keep writing this kind of texts, you will get a lot of people to this page if you continue doing this.

LikeLike

So, I came across your blog and I resonated with this article the most. . Where may I learn more?

LikeLike

I personally don’t think that I’ve ever been good at accepting change for 3 week diet, but as a business owner, I have to do my best to make sure that that I help the people that are affected by 3 week diet it as it happens. Change is inevitable and can happen for so many reasons – because your services need to be refined, or prices change, or you have problem with stock in storage 3 week diet

LikeLike

Really great information, thanks for the share and insights!

LikeLike