Following up on an article published in September on my page, shares of the three listed banks rose at least 24%, with DBS rising 29%. In this article, we will cover DBS’ financial result, released on 10 February 2021 and look into the outlook given by the company. This article will guide you in deciding whether to hold on to your bank shares or sell them away.

DBS FY Result

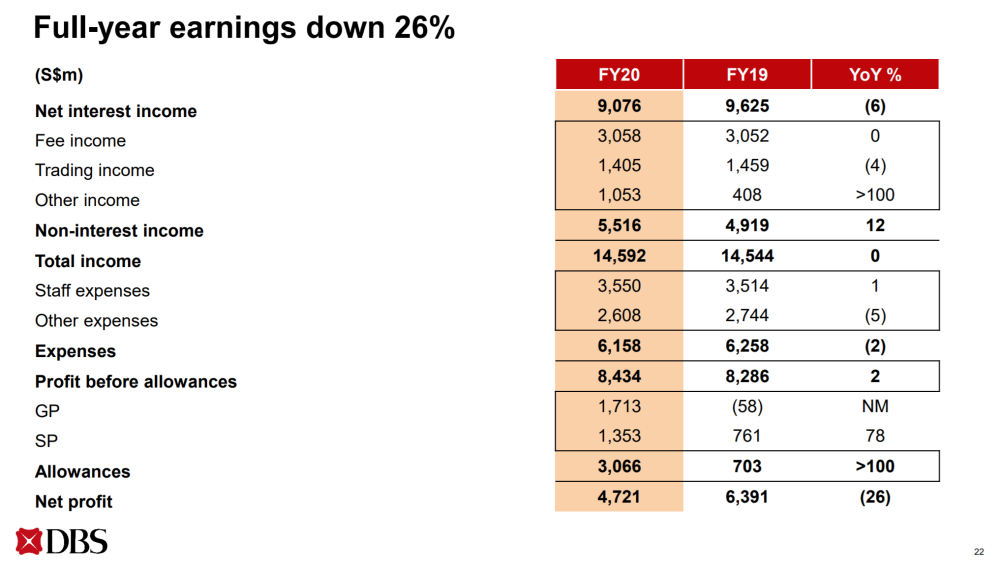

Total Income was flat for FY20 as the gain of 12% in Non-Interest Income offset the decline of 6% in Net Interest Income. Profit before allowances was 2% higher than the previous year as expenses were 2% lower as general expenses such as travel, advertising and promotions were lower. Total allowances quadrupled from the previous year to $3.07 billion as GP of $1.71 billion were conservatively set aside against potential risks arising from the pandemic. The increase in allowances resulted in net profit to decline by 26% from $6.391 billion to $4.721 billion

Net Interest Income declined 6% from $9.625 billion to $9.076 billion in the latest FY as the bank suffered a decline of 27 basis points to its Net Interest Margin from 1.89% to 1.62%. The decline of Net Interest Income was due to the sharp decline in interest rates. The decline in Net Interest Income was partially offset by loan growth of 4% for the year. The decline in NIM for the fourth quarter slowed compared to previous quarters and the bank is confident that the NIM has already bottomed. The bank expects NIM to stabilise between 1.45% and 1.5% in 2021.

Gross Fee Income was flat for the year as Cards and Investment Banking revenue suffered a decline which were offset by increase in revenue in Wealth Management and brokerage commissions. The bank highlighted that card spending in November and December were flat to pre-Covid levels and fourth quarter revenues for card spending have largely normalised and cards revenue had bottomed since then.

Total allowances quadrupled from the previous year to $3.07 billion as GP of $1.71 billion were conservatively set aside against potential risks arising from the pandemic. Note that the set aside rate for allowances slowed down in the second half of 2020 where only $1.131 billion were set aside compared to the $1.935 billion set aside in the first half of 2020. Furthermore, the bank also highlighted that the general allowances set aside in the fourth quarter was half the amount taken in the third quarter.

Instead of starting to write back reserves practised by the US banks in the fourth quarter on the back of improved macroeconomic conditions, DBS decided to use the fourth quarter to further fortify their balance sheet so that any potential vulnerabilities this year would have been provisioned for in 2020.

As the total allowances crossed the $3 billion mark, which is at the lower end of DBS’ guidance of between $3 billion and $5 billion for 2020 and 2021, DBS believes that the allowances set aside for 2021 should end up at the middle of their guidance of $4 billion. This means that DBS has already set aside the majority of the allowances in 2020 and taking another $1 billion in allowances in 2021, or around 25 basis points of loans. That’s similar to our credit cost under more normal business environments.

At the current juncture, DBS is unsure of how much it can write back on its allowances as its reserves include over $1 billion in management overlay, the bank might be able to write back some of the allowances if the macroenvironment improves over the course of the year.

Credit Quality and Outlook

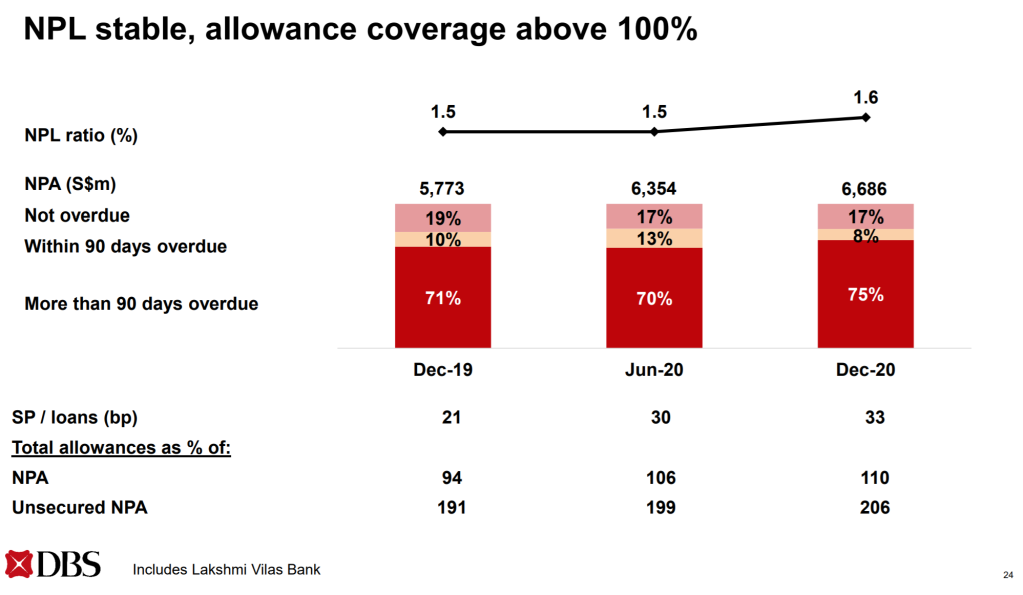

NPL remained stable at 1.6%, an increase of just 0.1% from 1.5% in June 20, this might be attributed to loans under moratorium. Note that all loans under moratorium are on a secured basis, regardless of whether they are SME loans or residential mortgages. As of the latest financial year, just over 1% of the loan book remains under moratorium. The mortgage book still has $500 million down from $5 billion at its peak, the Singapore SME book has $1.1 billion down from $4.6 billion, and the Hong Kong large corporate and SME book has $3.2 billion down from $6.6 billion.

Even under the extended scheme, applicants have to make partial principal repayments. Delinquencies have been low. 10% of $5 billion of housing loans under moratorium in Singapore have signed up for the extended scheme after the moratoriums ended. 25% of SME loans have applied for extended financial relief. 50% of loans under moratorium in Hong Kong applied for extended relief in January. DBS highlighted that companies which applied for extended relief are large corporates which are generally holding up well and the reason for their extension is to reduce their borrow cost.

In general, asset quality on loans that are out of moratorium are encouraging. For loans that are out of moratorium, payments on loans are on original terms and only a small number of borrowers are delinquent, Delinquencies came down sharply for its consumer book, though the bank believes that the government scheme is masking some delinquencies. The bank’s capacity to collect has improved as the economy recovers. The bank is confident and feeling more optimistic than before based on the recent trends.

Dividends

DBS was asked to hold dividends at 18cents per quarter for four quarters including the end of the first quarter. This means that withholding of dividends will continue for DBS for another quarter. On whether MAS will relax the restriction remains to be seen but DBS emphasised that they have the capacity to pay more dividends than what it is paying for now.

Outlook

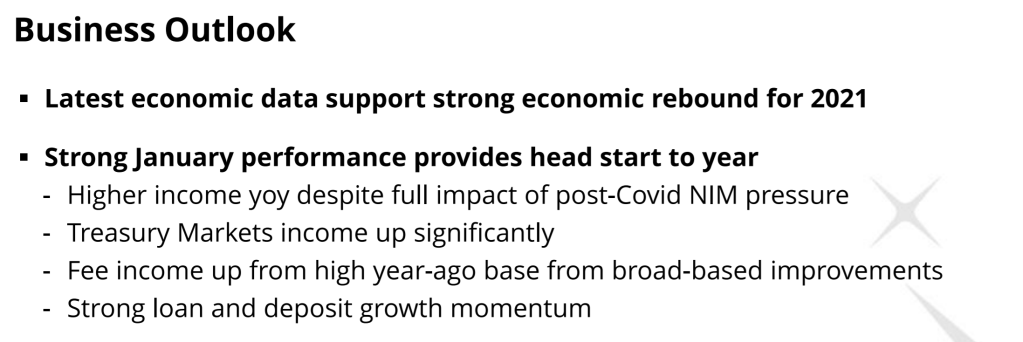

DBS is upbeat on its outlook for 2021. DBS disclosed that its performance in January has been quite strong, providing a head start to the year. Overall income was up compared to January 2020 despite the sharp drop in rates, suggesting strength of the business. Fee income was very strong in January. Wealth management, brokerage and transaction services are up year-on-year, while cards and bancassurance were flat. DBS is confident that fee income growth can hit double digit growth based on strong January performance. Furthermore, DBS is also revising upwards is guidance to its loan growth for the first quarter to 2% from the previous 1% – 1.5% growth. DBS is uncertain that the trend will continue for the remaining year but it is confident that it will be able to achieve the mid single digit loan growth that it is targeting.

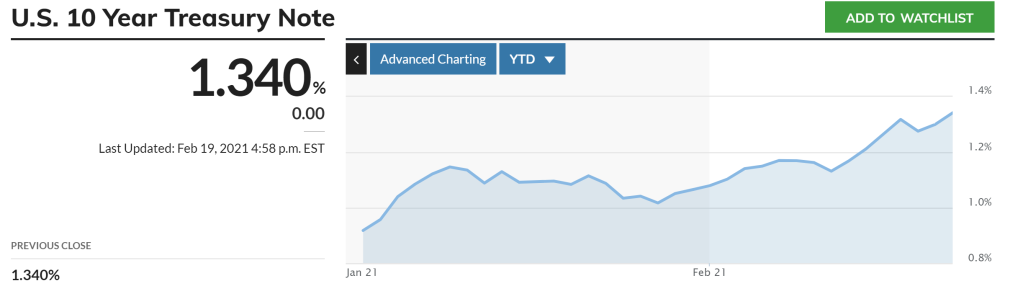

Updates on Treasury Yield

US 10Y Treasury Yield rose from about 0.91% at the start of the year to 1.34% lately. The rise in yield is attributed to an anticipation of a tightening of policy sooner than anticipated to accomodate a potential rise in inflation, along with the stronger global growth expected as more people get vaccinated, thus resulting in pent up consumer demand.

Yield curve has steepened compared to a year ago as it indicates an expectation that economic growth and inflation will rise in the future. Steeper yield curve is good news for banks as they borrow for a shorter period and lend out for a longer period, earning the difference between the spread.

Closing Thoughts

I strongly believe that the worst should be over for banks in general as they have already front loaded majority of the allowances in 2020 for potential risks arising from the pandemic. Steepening yield curve has a tailwind effect on Net Interest Margin and Net Interest Income in which I expect growth in both in 2021 as it recovers from a low base in 2020, supported by strong economic data. The wild card for now will be the delinquency rates for loans that are under the extended moratorium scheme. DBS expects the delinquency rates for the cohort to be slightly worse than those loans which are already out of moratorium. However, DBS is confident that the allowances set aside for 2020 and 2021 to be in the mid range of between $3 billion and $4 billion, meaning that it only has to take in another $1 billion in allowances in 2021, with a possibility of writing back of provisions in the coming year.

Therefore, with the above, I am confident that the worst should be over for banks, but whether the optimism in outlook has been priced in since September last year remains to be seen. I will continue to hold DBS for dividends and potential capital appreciation.

Follow Frugal Youth Invests

Hope that you like today’s article and the resource!

There are two ways in receiving instant notification of any new posts, you may follow my page by entering your E-Mail which can be found at the right sidebar or you can also click on the follow button too!

You can also share this article with your friends, if you find it useful.

Also, do follow me on Stocks.Cafe, for the latest update made to my portfolio.

The Haryana Board of Secondary Education will release the HBSE 10th Syllabus 2022 in pdf format. The syllabus for many disciplines has been changed by the board. As a result, students must obtain Haryana 10th Class Syllabus 2022 the most recent revision of the class 10 syllabus. The 10th board syllabus is published separately for each subject, such as English, PE, Home Science, Mathematics, Science, and so on.

LikeLike