I am heartened to receive such a great response on an article that I published in March where I revealed my portfolio to everyone, sharing my investment strategy and my stock picking rationale. As shared in that article, the only time I held REITs were in 2018 where I bought into Mapletree Logistics Trust and Frasers Logistics and Industrial Trust as they offered attractive distribution yields of more than 6%. However, as I stayed in the market longer, I decided to change my investment strategy to growth. Although I do not currently own any REITs, I believe that there’s no harm in sharing how I would invest in S-REITs as a teenager who has been in the market for 3 years. In this article, I will be sharing the REITs that I would own if I were still a dividend investor and the rationale. Also, I will be explaining why I will invest S-REITs with Syfe REIT+.

5 must have S-REIT in your portfolio

1. Parkway Life REIT (Healthcare)

Parkway Life REIT is one of Asia’s largest listed healthcare REITs, which invests in income-producing real estate used primarily for healthcare and healthcare-related purposes. PLife owns 53 properties in Singapore, Malaysia and Japan worth about $2 billion as at 31 March 2021. It owns Mount Elizabeth Hospital, Gleneagles Hospital and Parkway East Hospital located in Singapore.

Since its listing in 2007, PLIFE has not recorded a decline in DPU YoY but instead it has grown steadily at a rate of 118.2% from 6.32 cents in 2007 to 13.79 cents in 2020. This uninterrupted recurring DPU growth since listing could be due to two reasons where 95% of its gross revenue has downside protection and the rent structure as shown below.

There’s two formulas in calculating the rent for the year – the first being Base Rent + Variable Rent while the second being CPI + 1% formula. PLife will receive rent from the formula that derives a higher rent payout, thus ensuring growth in revenue each year. In the event where there is a deflation, the CPI used in the formula will be 0, thus ensuring that there will be 1% growth compared to the preceding year.

The distribution yield of 3.19% based on FY20’s distribution and at closing price of $4.31 may sound unattractive for many dividend investors, but it is important to note that it has a 14 years track record of uninterrupted distribution growth. Instead of looking at high distribution yield healthcare REITs such as First Reit, it is reasonable to pay a premium for a quality REIT that would increase its distribution yield by cost over the years.

2. Mapletree Commercial Trust (Retail + Office)

Mapletree Commercial Trust is a REIT listed in Singapore that has a principal investment strategy of investing in a diversified portfolio of income-producing real estate used primarily for office and/or retail purposes. MCT’s portfolio comprises five properties in Singapore worth $8.7 billion and some notable properties under their management are Vivocity and Mapletree Business City.

Similar to FCT, MCT has yet to record a decline in DPU YoY since its listing in 2011, except in 2020 where the pandemic hit the retail sector. MCT saw its yearly DPU almost doubled from 5.27 cents in 2011 to 9.49 cents in 2021. In fact, MCT recorded an all time high DPU in 2021 when it released $28 million of $43.7 million retained in 4Q FY19/20 to better position itself for COVID-19 uncertainties. This shows that the management is forward looking to diversify its revenue streams while battling with the pandemic, resulting in an increase of $22.7 million in amount available for distribution (excluding what was released).

What is fascinating about MCT is the fact that despite only acquiring a few properties since its listing in 2011, the amount available for distribution increased even in years where there were no acquisitions. This shows how capable the management is in growing its existing properties’ revenue organically, partly due to its best in class portfolio where it owns Mapletree Business City and Vivocity.

Based on the 2021 distribution of 9.49 cents and at a closing price of $2.06, MCT is trading at a 4.6% distribution yield. It is very rare for MCT to trade at such distribution yield and it is the perfect opportunity to own such a great REIT with a quality portfolio and a track record of increasing its DPU each year.

3. Keppel DC Reit (Data Centres)

Keppel DC Reit is the first pure-play data centre REIT listed in Asia and Singapore. KDC’s investment strategy is to invest in a diversified portfolio of income-producing real estate assets which are used primarily for data centre purposes, as well as real estate and assets necessary to support the digital economy. The REIT owns 19 data centres that are worth $3 billion, spanning across 12 cities in eight countries in Asia Pacific and Europe.

Since its listing in 2015, KDC has yet to record a decline in DPU YoY but in fact its DPU growth accelerated in FY20 where it recorded a DPU growth of 20.5% from 7.61 cents in 2019 to 9.17 cents in 2020. It is unusual for a REIT to grow its DPU growth at such a rate and I believe KDC is the only REIT that is able to achieve double digit growth even with equity funding that expands unit base count.

Demand for Data Centres continues to increase and accelerate due to the pandemic where many companies are adopting technology at a much faster pace. KDC shared that enterprise spending on cloud infrastructure grew more than 30% in 2020, and is expected to continue expanding at a CAGR of >20% through 2025.

Based on the 2021 distribution of 9.17 cents and at a closing price of $2.59, KDC is trading at a 3.54% distribution yield. KDC deserves to trade at such a distribution yield as it is a resilient asset class where it is highly defensive and has a sustainable income stream with long-term growth visibility. This asset class could also be used as a proxy to the fast growing technology sector (where technology companies do not usually give out dividends). Similar to PLIfe, it is reasonable to pay a premium for a quality REIT that would increase its distribution yield by cost over the years. Alternatively, you might want to consider investing in Mapletree Industrial Trust where 55% of its assets are now data centres.

4. Mapletree Industrial Trust (Data Centres + Industrial)

Mapletree Industrial Trust is a REIT listed in Singapore that has a principal investment strategy of investing in a diversified portfolio of income-producing real estate used primarily for industrial purposes in Singapore and data centres worldwide beyond Singapore. MIT’s $8.6 billion property portfolio is well-diversified into various asset classes such as Data Centres, Hi-Tech Buildings, Business Park, Flatted Factories, Stack-up/Ramp-up buildings and Light Industrial. It recently announced an acquisition of US$1.32 billion of Data Centre Portfolio in the United States and this acquisition will result in 54% of its AUM in data centres, in line with the management’s target of 67% of its AUM in data centres.

I wrote two articles comparing Mapletree Industrial Trust and Ascendas Reit in 2019 and 2020 and I was impressed how MIT’s performance metrics have improved significantly in just one year. I believe that the performance metrics have also further improved since the last article comparison. I have been stressing how I prefer REITs to have a higher WALE as it means that the management does not need to find tenants thus providing stability in rental income. Since the last article comparison, WALE for MIT has increased from 3.9 years to 4.6 years.

Based on the 2020 distribution of 12.55 cents and at a closing price of $2.77, MIT is trading at a 4.53% distribution yield. Compared to KDC, MIT is at a relatively attractive valuation based on distribution yield as it exposes investors to data centres though only at 54% of its AUM. As management is building up its data centre portfolio, MIT could also be used as a proxy to the fast growing technology sector. I expect DPU to increase over the years, thus making its distribution yield of 4.53% attractive in the long run.

5. Frasers Centrepoint Trust (Retail)

Frasers Centrepoint Trust is a REIT listed in Singapore that has an investment strategy of owning and investing in suburban retail properties primarily in Singapore. FCT, is one of the largest suburban retail mall owners in Singapore, owning 10 retail malls such as Causeway Point and Northpoint City (North Wing) that are collectively worth $6 billion.

Similar to PLife, FCT has not recorded a decline in DPU YoY since its listing in 2006, except in 2020 where the pandemic hit the retail sector. FCT saw its yearly DPU doubled in 13 years from 6.03 cents in 2006 to 12.07 cents in 2019. One of the investment merits of investing in FCT is the resilience of suburban shopping malls.

Suburban retail malls in Singapore generally have a higher proportion of essential services where 40% of NLA are allocated to essential services as compared to about 20-30% in central malls. FCT shared that 45.2% of its NLA are allocated to essential services, thus proving resilience during the pandemic. FCT saw its 2020 retail sales recovered quickly from trough in just 3 months, despite seeing a decrease of 30% traffic as compared to the preceding year.

It is unknown when the pandemic will be over and how long it will take for FCT to reach its 2019 distribution level. However, the management has taken steps to diversify its revenue streams by fully acquiring PGIM Real Estate AsiaRetail Fund to reduce the impact on amount available for distribution. Based on the 2019 distribution of 12.07 cents and at a closing price of $2.39, FCT is trading at a 5.05% dividend yield. Given the low interest rate environment, it is attractive to own this REIT with a track record of increasing its DPU each year.

How to invest in S-REITs?

1. Buying individual REITs through a brokerage of your choice

The first method in exposing yourself to REITs would be the conventional method of buying individual RETIs through a brokerage of your choice. This method allows you to only pay for one time fees of commission and all the management fees are being taken care of by the management backend. I prefer holding my REITs in my CDP account and one trade would already cost me $10 minimally on DBS Vickers Cash Upfront account. The problem with this method is that if you are looking to buy many of your favourite REITs (not just the 5 REITs in this article), you will have to incur more commission which will be counter-effective compared to buying a REIT ETF or using Syfe REIT+.

2. REIT ETF

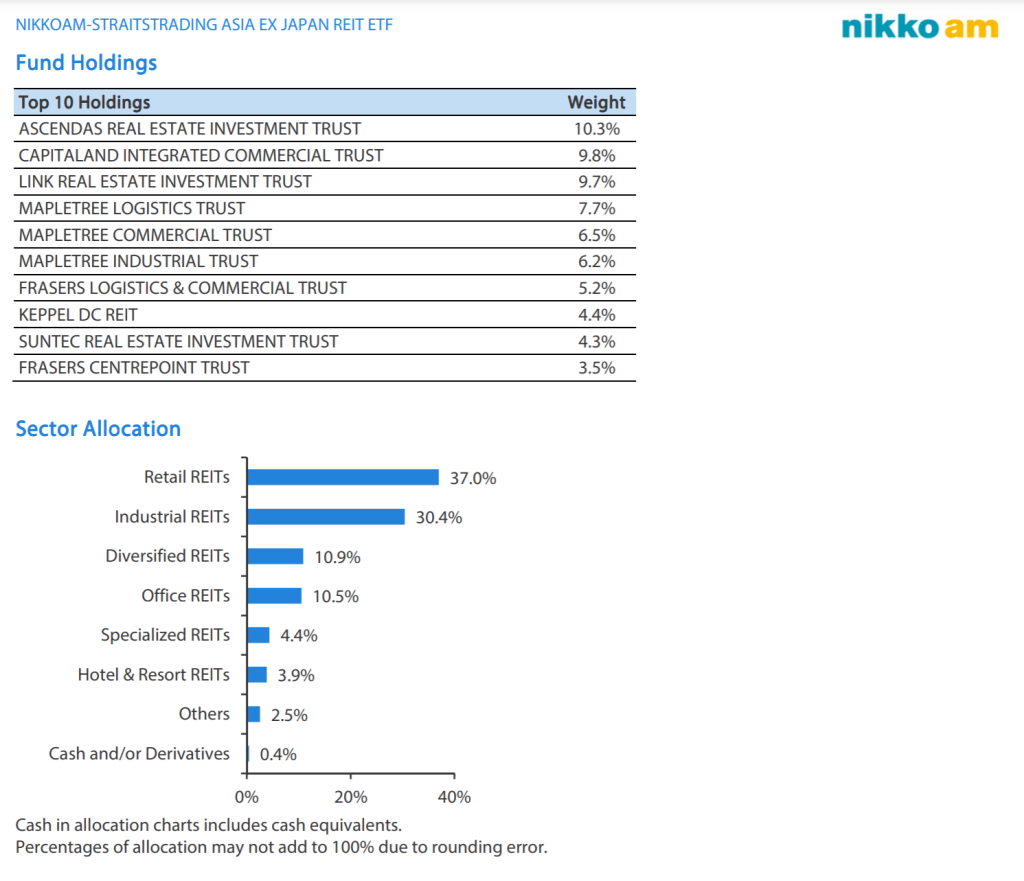

There are three REIT ETFs available for investors to invest in instead of buying them individually. Investors will only need to incur one time commission to have exposure to all the REITs in the ETF and management fees of the REIT and ETF are taken care of at backend as expenses. The three REIT ETFs available in the market are NikkoAM-STC REIT ETF (CFA), Philip AP Div REIT ETF (BYJ) and Lion-Phillip S-REIT ETF (CLR).

NikkoAM-STC REIT ETF (CFA) replicates as closely as possible, before expenses, the performance of the FTSE EPRA Nareit Asia ex Japan REITS 10% Capped Index. It has a management fee of 0.5% and its top 10 holdings include Ascendas Reit, Capitaland Integrated Commercial Trust, Link REIT, Mapletree Logistics Trust, Mapletree Industrial Trust, Mapletree Commercial Trust which constitute 50% of the ETF holding.

Philip AP Div REIT ETF (BYJ) seeks to provide a high level of income and moderate long-term capital appreciation by tracking, as closely as possible, before expenses, the performance of the iEdge APAC Ex-Japan Dividend Leaders REIT Index. It has a total expense ratio of 1.16%, the highest among all REITs. There’s a lot of unknown companies or REITs in its top 10 holdings which include Mirvac Group, Dexus, Stockland, Goodman Group, Scentre Group and GPT Group. These companies or REITs constitute 44% of the ETF holding. BYJ ETF might not be the ETF to look for if you are looking to invest in S-REITs as 55% of its ETF holdings are in Australia while 29% of its ETF holdings are in Singapore and 12.61% in Hong Kong.

Lion-Phillip S-REIT ETF (CLR) aims to replicate as closely as possible, before expenses, the performance of the Morningstar® Singapore REIT Yield Focus Index. It has a management fee of 0.5%, comparable with CFA ETF and all of its holdings are REITs listed in Singapore. Some of its top 10 holdings include Mapletree Industrial Trust, Mapletree Logistics Trust, Ascendas Reit, Capitaland Integrated Commercial Trust, Mapletree Commercial Trust, Keppel DC Reit and Parkway Life Reit, which constitute about 70% of ETF holdings.

It is up to individuals to choose which REIT ETF would best offer their investment strategy on REIT. As for myself, after looking at the REIT ETFs offering, it only boils down to CFA and CLR ETFs as both have low management fees of 0.5% and offers some form of geographical diversification. If investors would prefer to only invest in S-REITs, they may go for CLR ETF while if investors would prefer some exposure to REITs listed in other countries, they may go for CFA ETF. For today’s article comparison, I will be using CLR as the main focus of the article is S-REITs.

3. Syfe REIT+ (Writer’s choice)

Syfe offers REIT+ to investors who are keen in S-REITs and dividend investing. Syfe is the first robo-advisor in Singapore to offer a REIT focused portfolio that tracks the SGX’s iEdge S-REIT Leaders Index. iEdge S-REIT Leaders Index has the most liquid representation of the S-REIT market in Singapore. It is a narrow, tradable, adjusted free-float market capitalization weighted index that measures the performance of the largest and most tradable REITS in Singapore.

Unlike investing in a REIT ETF such as CLR where dividends are distributed in cash, Syfe REIT+ allows dividends to be automatically reinvested into the portfolio that could generate additional 0.5% in returns over time. This is a by default arrangement by Syfe for all of its clients investing in this portfolio but clients on Syfe Black, Gold or Platinum have an option to either receive their dividends as quarterly payouts or have them automatically reinvested.

The image above shows the REITs allocation of REIT+. This allocation follows closely with SGX’s iEdge S-REIT Leaders Index’s constituents. There are 7 REITs in this portfolio that are in the components of the Straits Times Index, namely Ascendas Reit, CapitaLand Integrated Commercial Trust, Frasers Logistics and Industrial Trust, Keppel DC Reit, Mapletree Commercial Trust, Mapletree Industrial Trust and Mapletree Logistics Trust. These REITs constitutes about 63% of REIT+ portfolio. The REITs are included in the coveted Straits Times Index as they are highly traded and one of the largest listed companies in Singapore based on market capitalisation. In addition, I will also be sharing some notable REITs in this portfolio that are worth investing individually. These notable REITs, which constitute about 84% of REIT+, are some of my favourite REITs that are worth investing with a proven track record and potential for growth, be it organic or inorganic.

Syfe REIT+ VS Reit ETF

I always believe how expenses based on AUM will be expensive in the long run until I did my own calculation comparing the cost of holding Syfe REIT+ and CLR.

In the calculation below, I assume that I pump in $360 every month into each Syfe REIT+ and CLR (using FSMOne ETF). As CLR ETF has management fees of 0.5%, I would have to take into account these expenses even though this is done by backend by the management as expenses. The expenses incurred on management fees alone on CLR ETF is $22.43 for every $4320 pumped in yearly. Together with the commission incurred by FSMOne ETF, toal expenses incurred is $35.27 for every $4320 pumped in yearly, that’s an expense ratio of 0.79%. This is compared to 0.65% charged by Syfe, where it only costs $29.16 for every $4320 pumped in yearly.

The graph below shows how much you can save if you were to use Syfe REIT+ compared to REIT ETF such as CLR. As Syfe has different tiers on management fees based on the amount of AUM in each account. Management fees will decrease in the long run if investors continue to pump money into Syfe. This means that the cumulated additional expenses if REIT ETF were bought will only increase in the long run. You will be able to see that the REIT ETF expenses are slightly more than Syfe REIT+, thanks to the competitive fees charged by Syfe. Therefore, I would invest S-REIT with Syfe REIT+.

Frugal Youth Invests X Syfe

Readers who are interested to sign up for an account with Syfe to invest their funds into Syfe Cash+ or their investment portfolio (Syfe REIT+ etc) may do so by using my referral code – SRPSRBJRS. A minimum deposit of at least $1000 will allow you to enjoy a fee waiver of 3 months on the first $30,000 invested in their investment portfolio!

The above screenshot shows where you should include the referral code to enjoy fee waiver of 3 months when you deposit and invest a minimum amount of $1000 with Syfe!

For readers who failed to enter a referral code upon registration, they have up to 14 days to enter the referral code – SRPSRBJRS directly through the “Account Settings” tab of their Syfe dashboard. You may refer to the screenshot above on where you can include the referral code.

The referral code will help keep the site financially sustainable.

Follow Frugal Youth Invests

Hope that you like today’s article and the resource!

There are two ways in receiving instant notification of any new posts, you may follow my page by entering your E-Mail which can be found at the right sidebar or you can also click on the follow button too!

You can also share this article with your friends, if you find it useful.

You may follow my Stocks Cafe profile if you want to be the first to know of my portfolio changes going forward. I use Stocks Cafe to track all my equities and cryptocurrencies transactions. Please refer to this article if you are interested in the finance tools I use.

You may sign up an account with my code so that you can enjoy the features of being a Friend of StocksCafe and test out all the features above for free for two months. I am sure that trying it out will change your portfolio tracking experience entirely.

Hi – am looking at the Syfe reit+ vs DIY which you shared here, can I check how do you derive potential portfolio value?

LikeLike

I use the average return given by Syfe on their website.

LikeLike

CGBSE (Chhattisgarh Board of Secondary Education) is a board of education in the state of Chhattisgarh that has developed and adopted curriculum and syllabus. The National Council of Educational CG Board 12th Syllabus 2022 Research and Training is a self-governing body of the Indian government. Download the latest CG Board 12th Class Syllabus 2022 for NCERT, which is very important for students.

LikeLike