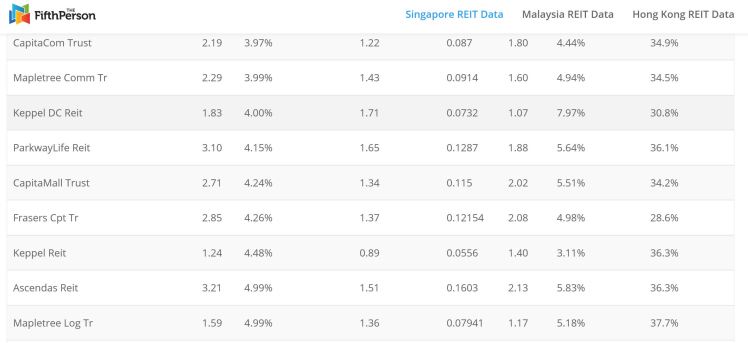

2019 is definitely a good year for investors investing in REITS. Some REITS such as Mapletree Commercial Trust has already risen about 35% YTD and has been included as one of the components of STI Index. A look at REITS Data provided by The FifthPerson, you could see that there are a handful of big name REITS such as Ascendas Reit, CapitaMall Trust, Frasers Centrepoint Trust yielding less than 5% and some even yielding less than 4% like CapitaCommercial Trust, Mapletree Commercial Trust and Keppel DC Reit.

However, majority of the REITS listed in Singapore are still yielding more than 5%. I have picked a handful of REITS to analyse and will be posting the analysis in the next few weeks.

The REITS are:

- ESR Reit vs AIMS APAC Reit

- Cromwell European Reit vs IREIT Global

- Keppel Pacific Oak US REIT (KORE), previously known as Keppel-KBS US REIT vs Manulife US Reit

Introduction to Cromwell European Reit and IREIT Global

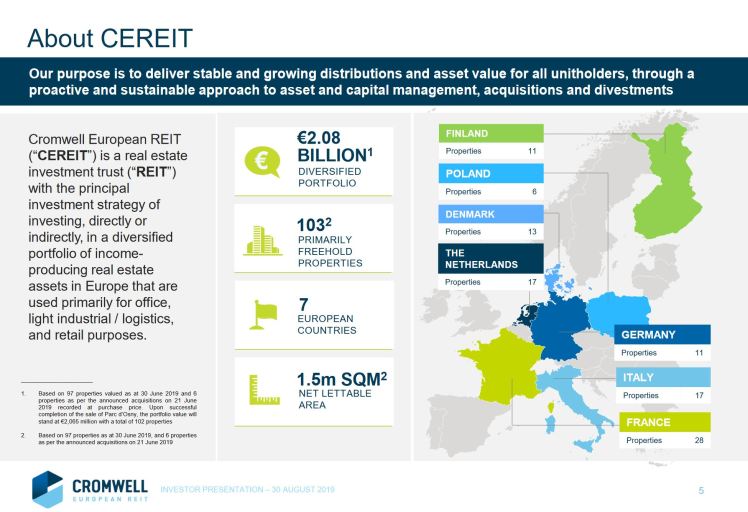

Cromwell European REIT is an industrial real estate investment trust listed in Singapore. It owns 103 properties in or close to major gateway cities in Denmark, Finland, France, Germany, Italy, the Netherlands as well as Poland, and a balanced focus on the office and light industrial / logistics sectors and retail purposes.

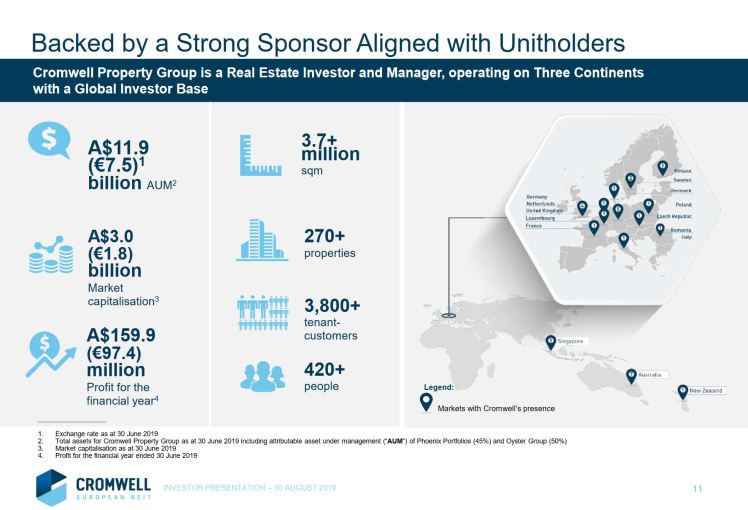

Cromwell Property Group is the sponsor for CEREIT. Cromwell Property Group is a real estate investor and manager that owns, manages and invests in commercial property. Cromwell Property Group owns more than 270 properties worth close to $12 billion in 15 countries across Australia, New Zealand and Europe.

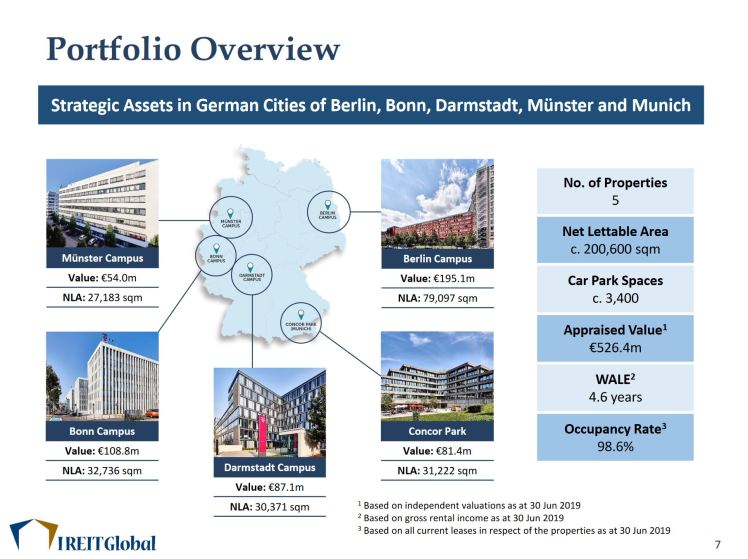

IREIT Global is an industrial real estate investment trust listed in Singapore. It owns five freehold office properties in German cities of Berlin, Bonn, Darmstadt, Münster and Munich.

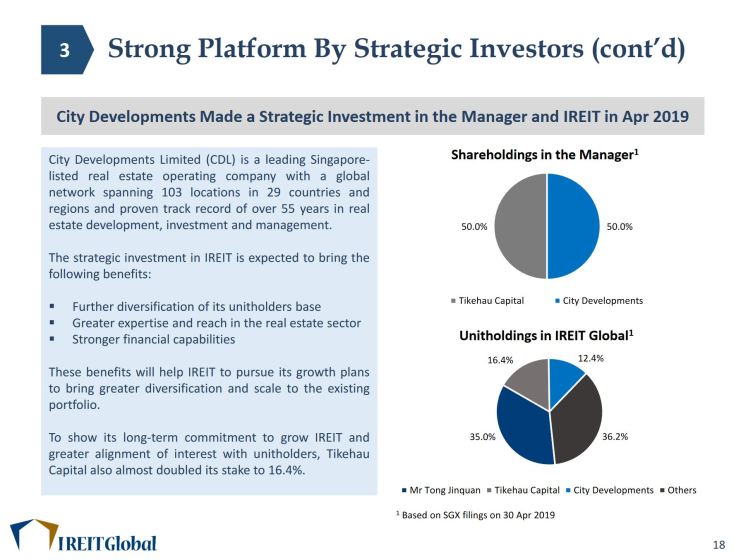

IREIT Global is managed by IREIT Global Group Pte. Ltd which is jointly owned by Tikehau Capital and City Developments. Tikehau Capital is an asset management and investment group which manages about €8.0b worth of real estate in Europe. City Developments is a leading global real estate operating company with a network spanning 103 locations in 29 countries and regions. Its income-stable and geographically-diverse portfolio comprises residences, offices, hotels, serviced apartments, integrated developments and shopping malls.

IREIT Global is managed by IREIT Global Group Pte. Ltd which is jointly owned by Tikehau Capital and City Developments. Tikehau Capital is an asset management and investment group which manages about €8.0b worth of real estate in Europe. City Developments is a leading global real estate operating company with a network spanning 103 locations in 29 countries and regions. Its income-stable and geographically-diverse portfolio comprises residences, offices, hotels, serviced apartments, integrated developments and shopping malls.

Portfolio Overview

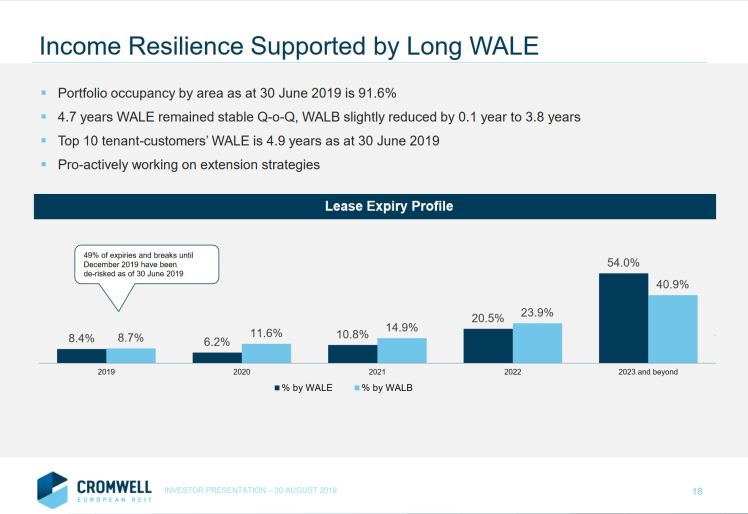

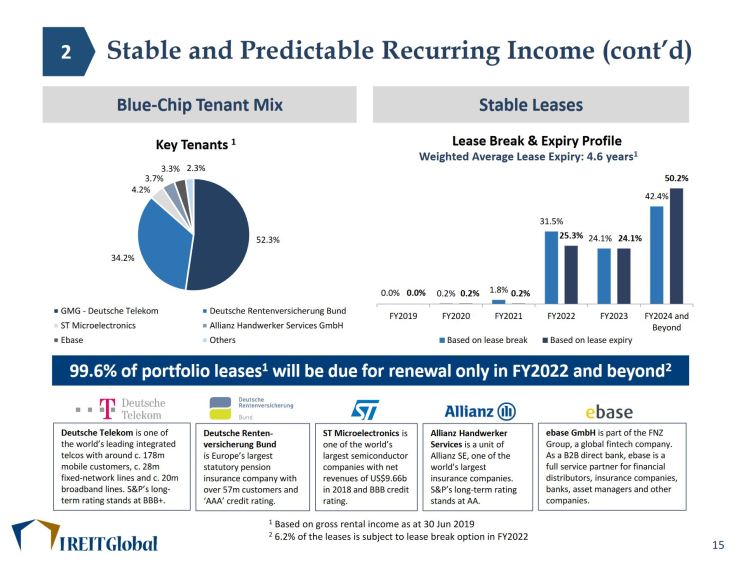

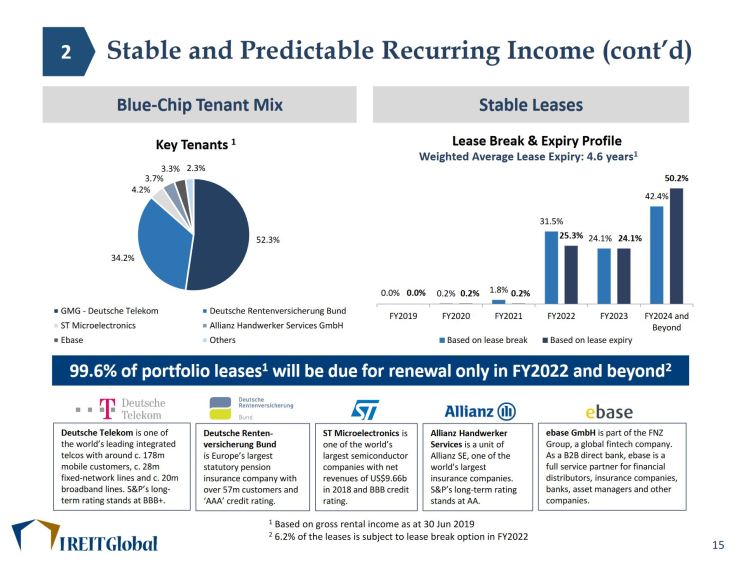

With reference to the image from the previous section, occupancy rate for IREIT is higher than CEREIT at 98.6% and 92.1% respectively. Moving on to lease expiry, only 0.4% of IREIT Global lease is expiring in the next three years, compared to 25.4% from CEREIT. In addition, WALE for CEREIT’s portfolio is 4.7 years which is slightly higher than IREIT Global’s 4.6 years. I am a fan of higher WALE as having higher WALE means that the management does not need to find tenants thus providing stability in rental income. However, the con of having a longer WALE is that if the REIT will miss out any opportunity of rising market rental rates unless there are rental review in the lease. I like the lease expiry of IREIT Global because for the next three years as the rental income will be stable but there is a problem with its tenant bae which I will cover now.

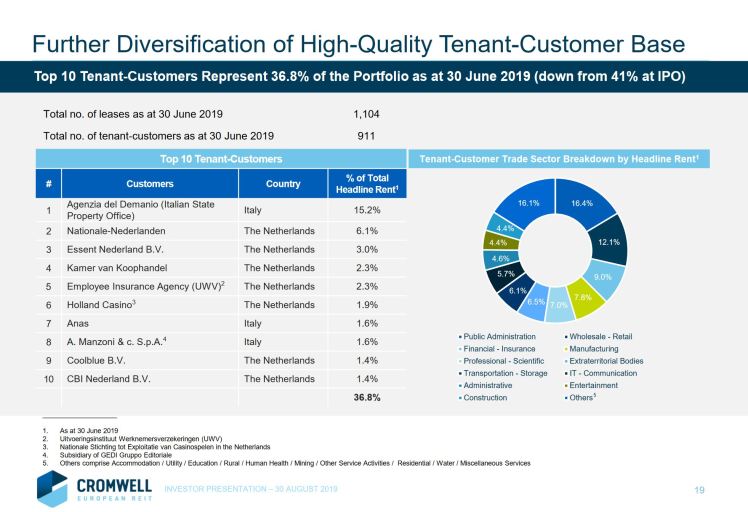

CEREIT has over 900 tenants while IREIT Global only has just 5 or more tenants to count on. IReit Global has key tenant risk as its two top tenants – Deutsche Telekom and Deutsche Rentenversicherung Bund contribute 86.5% of gross rental income. On the other hand, CEREIT’s top tenant contributes 15.2% of gross rental income. As IREIT Global only has that number of tenants, its blue chip tenants contribute over 95% of its rental income. On the other hand, CEREIT’s Top 10 tenants contribute 36.8% which is slightly lower than the 41.1% at IPO.

I feel that IREIT Global acknowledges that the tenant risk is very high and therefore it has painstakingly emphasise that the tenants are of blue chip. Take for example, the largest contributor – Deutsche Telekom is one of the largest integrated telcos with over 178 million mobile customers or the Deutsche Rentenversicherung Bund, the second largest contributor, is Europe’s largest statutory pension insurance company with “AAA” credit rating. It is up to the investor to decide whether is it worth the risk to invest in this REIT where it only depend on just 5 or more tenants. It is choosing between REITS with 5 or more tenants that are established and more than 900 tenants that are foreign to almost everyone.

Debt

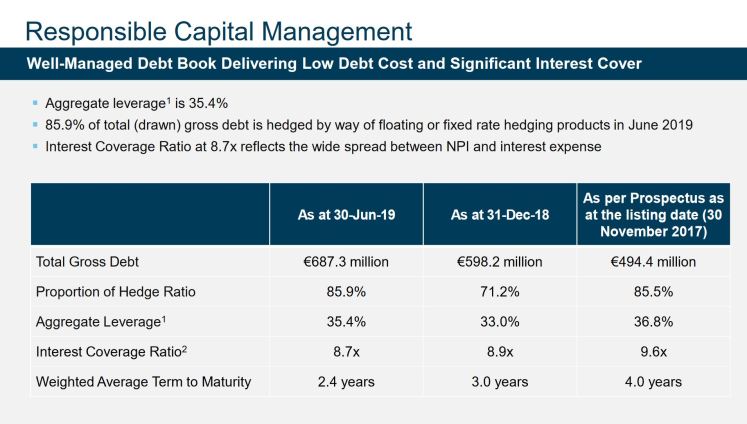

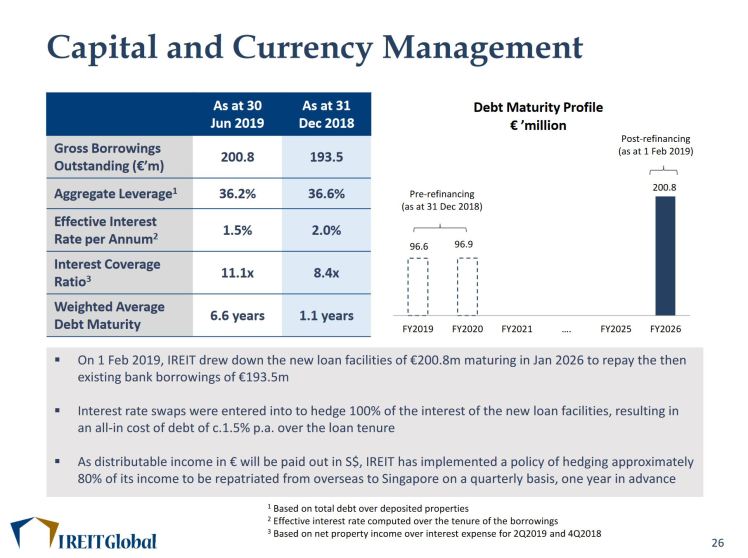

In this section, we will take a look at the financial health of the REITs. Debt is very important for REITS and investors as this is one of the few methods that REITS finance to acquire properties. We will look into the Gearing Ratio and Interest Coverage Ratio. Gearing Ratio of CEREIT stands at 35.4% while IREIT stands at 36.2%. A lower gearing ratio will be preferred in this case. As for Interest Coverage Ratio, IREIT has higher figure at 11.1x while CEREIT is at 8.7x. Interest Coverage Ratio means how much times its EBIT can cover the Interest Expense. It also determines how easily a company can pay interest on its outstanding debts. Therefore, a higher Interest Coverage Ratio will be preferred.

With that being said, we shall look into the funding cost for both REITS. Funding cost for IREIT stands at 1.5% while CEREIT’s figure stands at 1.34%. You might think that the funding cost for both REITS are impressive but please take note of the low to negative interest rate in Europe. For example, CEREIT has loan from different countries such as Italy, France and The Netherlands where interest rate is 0% while Denmark is at -0.65%. One question came to my mind is whether the funding cost for both REIT be slightly lower than what is reported after taking into how their credit score due to the size of the REIT?

CEREIT fixed interest rate stands at 85.9% while IREIT figure stands at 100%. In Arising interest rate environment, it will be wise to select REITS that have higher percentage of debts on fixed rates. When debts are fixed rate, it means that the management has already hedged its interest rate and REITS will not be affected by any rising interest rate. However, with the recent announcement by the Federal Reserve cutting interest rates, a lower percentage of debts on fixed rates will be preferred as REITs will be paying more interest since majority of its loans are on fixed rates thus reducing its distributable income to unitholders.

Closing Thoughts

I believe that both REITs are worthy to invest in. I think investors are spoilt for choices which to pick. I honestly do not have any major concern about CEREIT but for IREIT it will be the tenant concentration risk. I feel that this makes investors to ponder whether they should take on this risk and whether the dividend yield compensates the risk that has to be taken. One might think that blue chip companies are hard to fall. Take a look at Hyflux and imagine that is Hyflux contributing 53% of rental income. With just 5-6 tenants for IREIT, I believe that all properties are single-tenanted. I think this poses a bigger risk if one of the tenants,especially the one contributing more than 53% backs out. I understand all REITs have security deposits to put in place but it is still risky especially the largest tenant contributing more than half of the rental income. With that in mind, I would choose Cromwell European Reit over IREIT Global.