Looking back at my own blog, it has been close to 2 months since I last posted any updates. You might be curious what exactly happened since I last blogged so I would like to share briefly before I move on to the purpose of this blog post.

As you all would have known, I have been serving the nation since July 2019 and I just recently got promoted to Lance Corporal in May. This means an additional $20 of allowance every month. In addition, I am reaching my one year milestone in about one month’s time so I am expecting a 5% increase in my allowance. I am looking forward to write my 1 year milestone post in July documenting my personal finance goals and probably investment too. Many NSF will say that this is the best time to serve the nation due to Covid-19. Business Continuity Plan was implemented ever since Circuit Breaker started in April, I have been working on alternate shift. This means coming to camp on certain days and “working from home” on the remaining working days.

Moving on to our main purpose of this post, I shall now share with you my Covid-19 crash experience and the key takeaways from this post.

Best time to invest is now

It’s just fascinating that in just a short period of time, you see many new investors starting to get interested in stocks, opening up brokerage accounts. Many people will say that this is the best year to start investing. Personally, I have a friend who approached me in December asking me how he can kick start investing in the markets but he was too busy with his work in camp that he did not take action. I have yet to keep in touch with him but I hope that he has taken advantage of the crash to start his investment journey.

Portfolio Performance

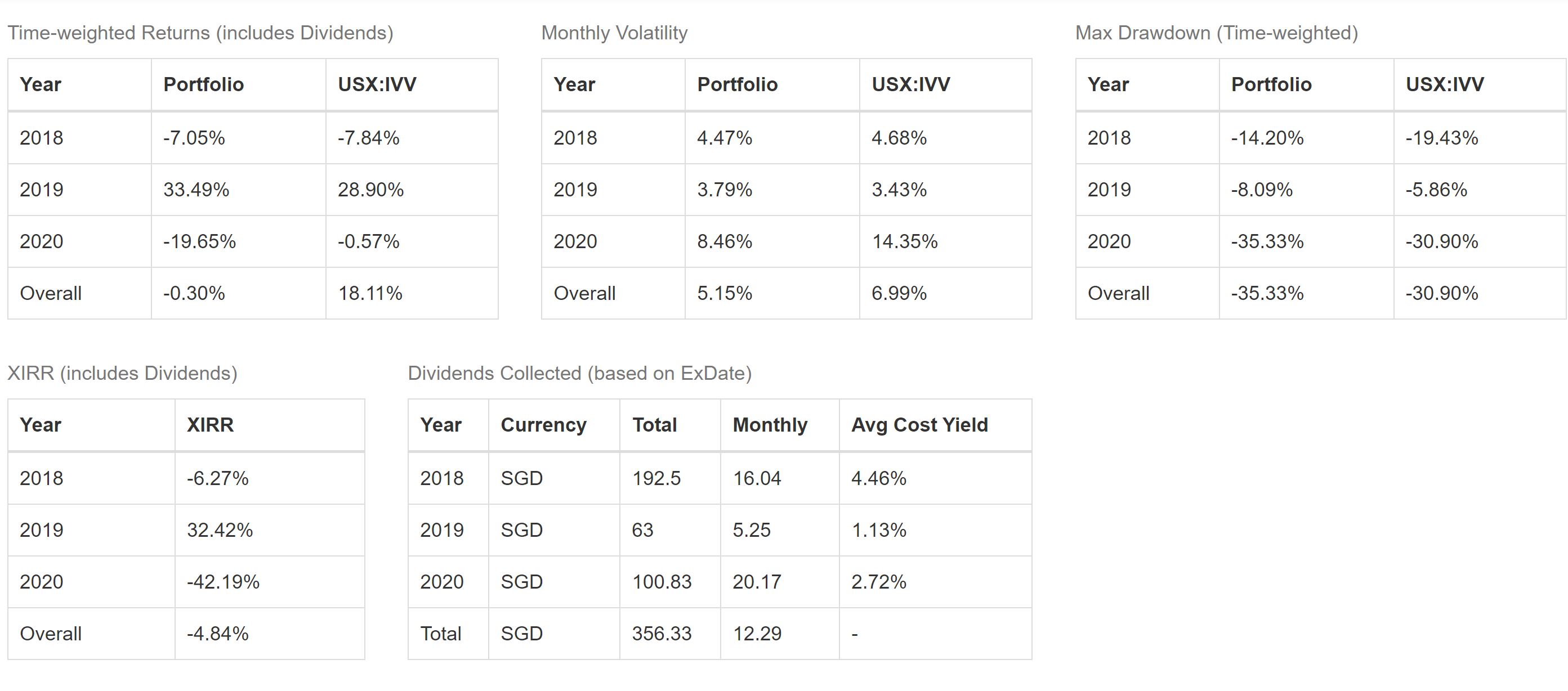

Ever since the market crashed in March, I have yet to add any major position besides my ETF RSP since March 23. I have attached my portfolio performance as of Friday, 29 May 2020. You will be able to see my portfolio time-weighted performance against ES3 (STI) or even IVV (S&P500).

My portfolio on Stocks.Cafe consists of Core Portfolio and ETF RSP Portfolio. Core portfolio is a portfolio that has all the stocks that were self-picked by myself. Currently, all of the counters are based in Singapore. This portfolio is mainly for dividend investing. On the other hand, ETF RSP Portfolio as the name implies, is to track the performance of ETF that I bought using FSMOne’s ETF RSP.

The above screenshot shows my current holdings and its performance since market crashed and bottomed on 23 March 2020. Note that I just averaged down DBS today and this is the first purchase since market bottomed.

The screenshot above shows the portfolio performance since inception. I track my performance against IVV which is a iShares S&P 500 ETF. My performance has been lackluster considering the fact that I did not participate in the relief rally until today. I am still building up my portfolio when opportunities come.

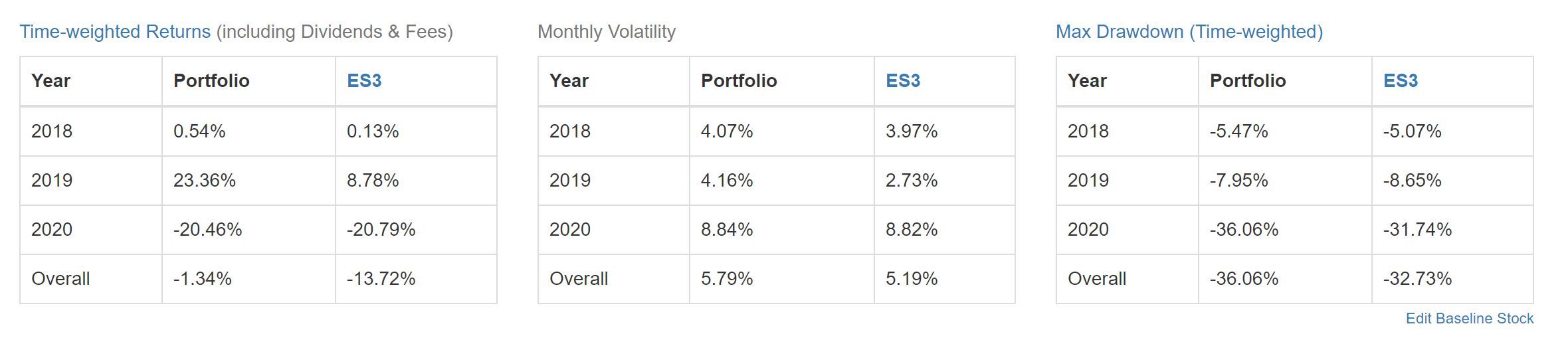

This is my Core Portfolio performance where I am currently comparing against ES3. 2020 Performance is in line with ES3 though it is still dragged by Lendlease Reit where at one point it was down more than 50%. It has now recovered to a certain extent.

We shall now dissect my ETF RSP portfolio, which I started early this year. This ETF RSP is made possible with FSMOne ETF RSP. FSMOne’s ETF RSP was introduced in late November, that was the period where I felt so frustrated leaving so much of my warchest unutilised and I told myself that 2020 will be the year to diversify to United States through ETF. Recently, FSMOne updated its ETF Focus List adding a few ETFs that caught my eye which include OShares Global Internet Giants or OGIG ETF. FSMOne also added Vanguard S&P 500 ETF which has a slightly lower expense ratio of 0.03% than IVV’s 0.04%.

On a normal occasion, I put in $200 from my NSF allowance into IVV and it is only recently that I increased the amount to $300 to take advantage of the falling prices so as to reduce my cost price. As I believe that the worse is not over, I am looking forward to putting in more if this is just a bear market rally.

Covid-19 crash stages, the respective experience and reflection

1. Initial Crash (Late Feb – Early March)

I was looking forward to it as I still had not deployed a significant amount of warchest into the market. I wasn’t worried at this stage as I had already experienced similar drops with Singtel in 2018 when it went close to 20% below my cost price. I was excited to take this crash as an opportunity to deploy my remaining warchest which I have been saving since I became mindful about managing my personal finance. The amount to be deployed for this frugal youth investor is quite significant in the eyes of many teenagers. As the market crash intensified, the substantial amount of warchest turned out to be limited and this resulted in me missing the bull/bear/relief rally completely. I acknowledged that because of the rate I am saving (at one point it was as high as 80% for warchest), I developed loss aversion where I rather avoid losses than to profit. I strongly believe that this is one of the reasons why I missed the rally.

When the market crashed, there were a lot of great companies selling at attractive prices but there’s just too little funds to be deployed at different tranches to prevent timing the market. I felt that with my warchest, if deployed in more than 2 tranches in at least three or four companies, the impact will be insignificant. The actions I took were to only add at most two companies as a new position and the remaining fund to be deployed to average down. The only stock that I am willing to put in more money to average down will be DBS as first it has the potential in capital appreciation and currently it is offering attractive dividend yield that is higher than any big cap REITs. I do not have any intention of averaging down my badly beaten Lendlease Reit as I do not want to expose too much on individual REIT as flashback to 2008, many of them issue dilutive rights to raise cash.

The two companies that I initially wanted to add as a new position are Netlink Trust and Industrial Reit. As for Industrial Reit, I was choosing between Mapletree Industrial Reit and Ascendas Reit. Therefore, I wrote a follow up analysis article on Mapletree Industrial Reit and Ascendas Reit and decided to go for Mapletree Industrial Reit since it owns a significant percentage of Data Centres. The reason why I chose Netlink Trust is because I prefer a defensive stock to be in my portfolio amidst this crisis. I like the business model and how it is pitching that 5G will not disrupt but in term grow its business. The only worry I have is the changes in regulations in the RAB model that will be reviewed in 2022. Any changes in nominal pre-tax WACC from 2022 onwards may impact the revenue, operating cashflow and dividend yield going forward.

My plan was changed at the last minute after I was convinced by my friend to explore US market. First of all, both of us are young so we should be seeking capital appreciation to grow our capital to be even larger and dividend investing with the amount of capital is insignificant at this stage. Without diving deep into any sort of analysis, my initial stock pick for US market is Microsoft and Visa.

It is important to deploy your fund correctly when one has limited funds to start off with. Deploy in a way that will generate better returns. This means to have preference in adding new positions than to average down stocks in your portfolio that are already beaten down badly. This prevents over exposing yourself to your existing positions.

2. Crash Intensified and Bottomed (Early March – Late March)

Things got uglier as the crash intensified from early march till late march. It’s definitely the first time seeing US indexes crashing more than 10% in one day and to come back up similar percentage points in another day.

We saw REITs came crashing down to levels not seen after 2019. We also saw defensive financial instruments or products like Gold, Bonds crashing in tandem with the overall equity market. Was this the Capitulation stage we are looking at? Maybe, maybe not, we do not know.

At this stage, it was definitely painful for everyone to look at their own current portfolio. For myself, I decided to delete my portfolio on the InvestingNote app which I frequently used to monitor so that I can forget the pain while the market continued to crash. I still remember Lendlease Reit, which is still my worst performer, crashed more than 15% in one day. It terrified me terribly but I couldn’t do anything as I felt cutting loss is a silly action to make. In addition, I have the holding power to hold indefinitely so I decided to stop monitoring it completely. It was effective as it is as if it did not exist in my portfolio at all. Right now, I do not have plans to overload this counter even though it is at an attractive valuation with a great sponsor and ROFR pipeline as there’s risk of cash call which I have to fork out more money in the coming years.

It might be unfortunate for some investors if they have already deployed all of their warchest before the crash. It is a black swan event that we do not think that it will happen. Aside from this, having significant holding power is imperative in riding out this crash.

For myself using the case study of Lendlease Reit, I do not know how long will it recover back to IPO price even after accounting for distribution, but I am confident that even if it has crashed, it did not cause panic for me to sell to cover my daily expenses or wants in the coming months. This is because I still have NSF allowance that I can depend on where 40% of the allowance is set aside for savings and expenses. Furthermore, I have an emergency fund that I can utilise for my own personal needs and wants.

Even if one have thought of topping up from their savings to take advantage of the crash, it is important to check your cashflow to forecast and predict whether it will affect your daily livelihood. Case in point, I had plans to top up in case the crash intensified. However, I have plans to utilise a significant amount of my savings and expenses to prepare for University life after I ORD in July. I have an Excel sheet that tracks my cashflow so I pump in numbers that I can predict and control to check if there will be any cashflow issue when I need the fund in the coming months. So after playing with the numbers, I discovered that I am able to meet my purchases even after topping up.

I believe that people have different risk appetite, I have friends who are willing to set aside 90% of its available cash for investment in this crash. Personally, I feel that this is risky if one does not have consistent cash inflow as the cash will just run out in matters of month.

3. Whatever rally you call it (Late March till now)

Pic credit: u/SpaceWanderer006 on r/wallstreetbets

March 23 2020 was a historic day for investors. It was the day the market bottomed and surprisingly it was the day when the Federal Reserve announced QE Infinity. I kept asking myself if I feel regret missing the rally and my answer is still an astounding Yes! This should be how ordinary investors will react unless they are permanent bear who think that the market will make a comeback. There were a lot of noises when the market bottomed a few days later. Some shouted that the rally is a dead cat bounce will bound to retest the bottom and I read an article that bear rally can last for as long as 4 or 5 months based on past events. However, the difference between the current situation and past events is that there was no QE done before 2008. Will we not be looking for any major pullback despite all the bad market data? I am not going to throw in my towel right now and enter as the downside risk is definitely higher than the upside as we do not know what’s ahead of us.

Key Takeaways

This section will be short but I am trying to put across key points that I have understood and realised during this crash. I hope that it will be useful for everyone if such a crisis comes again in the future.

- Do not all in, always buy in tranches

I feel this is the most important point that I want to make unless you have additional cash to average down in the future. In my previous reflection, I mentioned how I re-entered Koufu due to FOMO and in just one or two weeks after re-entering, the market came crashing down. In hindsight, I should have bought half of it, leaving the remaining to average down so that I do not need to fork out additional capital in which I can use it to initiate new positions.

I believe that buying in tranches is tricky in the sense that it depends on which cycle market is in. For example, it is recommended to buy in tranches when the market is crashing. Some might argue that one shouldn’t catch the falling prices but I feel that this will reduce the probability of missing the boat.

If we are referring to the current market condition where it has bottomed since 2 months ago and with Federal Reserve’s QE Infinity, I believe that one can decide whether to all in or still practise buying in tranches. Buying in tranches now is risking the remaining funds cannot be deployed unless there is a major pullback. On the other hand, all in right now is risking that if there is a major pullback, investors have to risk setting aside more money to average down since the market has risen significantly since it bottomed.

Always stick to your plan and don’t deviate much

When the market crashes, we are always tempted to try to buy at the bottom but it is impossible to time where it is. Sure, we can make use of US futures to decide whether we can wait for another day to transact. However, after being baited by it twice, I believe that one should just take it with a pinch of salt as it does not predict how the market will close for that day. All in all, we must resist the temptation of moving our goalpost significantly as markets are volatile and prices move very quickly.

Closing Thoughts

I should have pen down the key takeaways that I learnt from this crash but sadly I didn’t get to do it. I am sure everyone has learnt something from this crash. There will be opportunities down the road and with the lesson learnt, we sure have to get our act together and capture them. Once again, we do not know how long the relief rally will last so ensure that your own cashflow are in proper before capturing the buying opportunities.

Follow Frugal Youth Invests

I hope that you like today’s article. To receive instant notification of any new posts by Mail, you may like to follow my blog which can be found at the bottom of the page.

You can also share this article with your friends, if you find this article useful.

Vey interesting article !

The blog mentioned below will surely help readers and give a broader view on global equity market. Please share your views on the same.

https://fundamentalmarket.wordpress.com/2020/07/13/indian-equity-market-near-its-four-month-high/

LikeLike

Vey interesting article !

The blog mentioned below will surely help readers and give a broader view on global equity market. Please share your views on the same.

https://fundamentalmarket.wordpress.com/2020/07/13/indian-equity-market-near-its-four-month-high/

LikeLike